[澳纽加]澳元

[backcolor=rgb(238, 255, 238)]澳洲央行认为澳元会大幅下跌,“而不仅仅是下跌几分”。央行还表示担忧悉尼的房价。[/backcolor]

[backcolor=rgb(238, 255, 238)]央行行长史蒂文斯(Glenn Stevens)今日在候巴特举行的国际计量经济学会澳洲会议上发表讲话,还当面痛批夸大5月预算的政府和反对党前座议员。[/backcolor]

[backcolor=rgb(238, 255, 238)]史蒂文斯在会议上说,联邦预算似乎“不可能”对短期前景产生实际性的变化。[/backcolor]

[backcolor=rgb(238, 255, 238)]“预算未来2年的预估影响与我们此前预测的没有太大区别。”[/backcolor]

[backcolor=rgb(238, 255, 238)]他说澳元当前94美分的汇价高得离谱。此言一出,澳元应声下跌大约0.5美分至93.92美分。[/backcolor]

[backcolor=rgb(238, 255, 238)]小心悉尼房价![/backcolor]

[backcolor=rgb(238, 255, 238)]面对房市再次崛起,央行表示只担心悉尼市场。[/backcolor]

[backcolor=rgb(238, 255, 238)]史蒂文斯说:“信贷增长每年超出房市大约6-7%,或者说轻微高于名义收入增长趋势。”[/backcolor]

[backcolor=rgb(238, 255, 238)]“不管怎样...投资者还是应该小心悉尼市场,这里是借贷大幅增长的主要地区。新州投资者贷款的获批总额一共比2008年高出大约130%。”[/backcolor]

[backcolor=rgb(238, 255, 238)]“人们不应认为房价只升不降,事实不然,有时候房价会下跌。最近有些房地产市场确实有降温迹象,多个城市的房价都停涨,甚至是悉尼的增长速度都已经放缓。”[/backcolor]

[backcolor=rgb(238, 255, 238)]“目前这种房价涨速放慢的现象是临时的还是更持久的,还不得而知。在我看来,如果它能持续一段时间,那是良好的,原因有多个。如果未来几年,房价没有显著增长,而且建设活动保持在高水平,结果将有利于经济平衡发展,可以让更多人住得起房子。”[/backcolor]

[backcolor=rgb(238, 255, 238)]央行不认为房市再次崛起一定会导致利率上升。[/backcolor]

2楼

澳元跌不了多少………

这里是我的个人签名,但是我并不想用,因为在个人空间的记录里修改 ...

发表于:2014-07-05 10:20只看该作者

3楼

看完lz的帖子,我的心情竟是久久不能平静。

想当厨子的生物学家是个好黑客。

发表于:2014-07-05 14:23只看该作者

4楼

垒砌七星灶 铜炉煮三江

发表于:2014-07-16 13:26只看该作者

5楼

本帖最后由 awk 于 2014-7-16 21:49 编辑

Stevens是真正的难(不包括传言中他本人受到来自财长的压力). 简单说, RBA不可能在没有充分衡量对矿业投资缩减+贸易条件趋跌+套系活动盛行+AU经济结构改革进程影响+...的情形下加息, 但要减息, 受制于CPI(目前已经通道上端)+BRNZ输入通胀(超市NZ产的奶粉自4月以来有11%的升幅)+多数投入到房地产的信贷+...等等因素, 也难. 高盛的中文消息(不知道是不是在悉尼高盛团队给的结论)说RBA9月减息, 俺深表怀疑.

现在AU一般定存可以到5%以上, 小额贷款可以在10%以上, 基准工资也不低, AU仍然是个高成本的经济体.

最近, Stevens说"奇怪于USD/EUR为何如此低的汇率", 感觉像是他本人的牢骚--他怎么可能不知道为什么?!. 他还说CAD/USD/NZD都高(这位尊者有越俎代庖之嫌了,,哈哈), 这倒像是更对对RBNZ惠勒那斯的抱怨...:-)

PS: 惠勒这斯更像是苏沃洛夫元帅评说中的拿破仑, 哈哈.

韬客社区www.talkfx.co

发表于:2014-07-18 15:36只看该作者

6楼

Australian Treasurer Joe Hockey: Government shouldn't react to AUD strength Joe Hockey speaking from Sydney: 1. Bullish on Asia's prospects, opportunities for Australia 2. Can't envisage mini budget, double dissolution 3. Inflows, investor demand helping fuel demand for AUD

韬客社区www.talkfx.co

发表于:2014-07-22 14:37只看该作者

7楼

这是今天Stevens对"animal spirits"表达的原文, 似乎可以看出, 他本人并非特别愿意当鸽派:-)

.... "I think low interest rates are doing the sorts of things they normally do in most respects

," Stevens said in response to questions after a speech in Sydney today. "I'd still maintain up to this point that we're doing what can reasonably be done. But if there's more that can reasonably be done at some point, then obviously we'd do that

. But I'm content right now." Stevens's address today was a broad sweep across the 2008 crisis and major nations' responses, and looked at how the recovery could be accelerated. The Group of 20 nations' growth pledge could help revive activity

, Stevens said. "Unless we think the tendency for human optimism has been completely drummed out of us, animal spirits in the 'real economy' will surely improve at some point

," he said. "Reforms on the supply side of the G-20 economies can impart a sense of dynamism and opportunity." 'Huge potential' He said there is "huge potential" for public and private investment in infrastructure if governance, risk-sharing and other issues are "successfully tackled." Efforts to complete the main financial regulatory initiatives should deliver both "a safer system and less uncertainty," without unnecessarily crimping growth, he said. "The highly accommodative financial conditions will then have a more powerful effect in engendering real growth," Stevens said. "A rising confidence dynamic could unfold. The prospects for profitable investments by businesses would be significantly improved."

韬客社区www.talkfx.co

9楼

发表于:2014-07-23 10:45只看该作者

10楼

按照今天以前的调查, 36%市场预期RBA年底降息.

We'll see.

“The inflation outcomes are in line with the RBA’s recent forecasts and reinforce their message that what is required is a period of stability in interest rates,” said Michael Workman, an economist at Commonwealth Bank.

...The recent removal of a carbon tax by Parliament could also shave 0.7 percentage points off inflation in the third quarter, Deutsche Bank estimates....

韬客社区www.talkfx.co

11楼

发表于:2014-07-24 01:37只看该作者

12楼

韬客社区www.talkfx.co

发表于:2014-07-25 00:51只看该作者

13楼

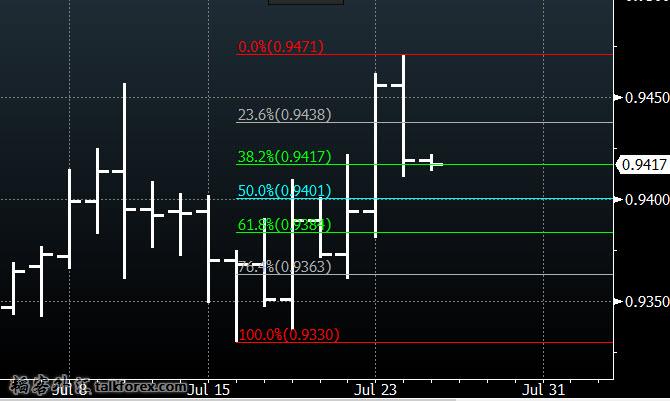

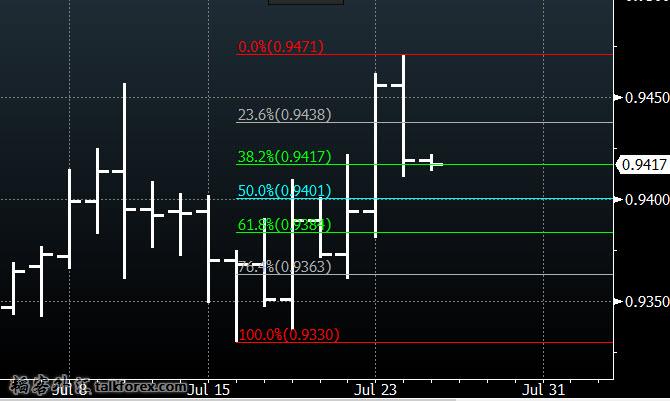

今天的图:-)

aud0ad017c0-e91d-4b48-86f7-032bd7359bef.jpg

aud0ad017c0-e91d-4b48-86f7-032bd7359bef.jpg

aud0ad017c0-e91d-4b48-86f7-032bd7359bef.jpg

aud0ad017c0-e91d-4b48-86f7-032bd7359bef.jpg韬客社区www.talkfx.co

发表于:2014-08-05 05:05只看该作者

14楼

RBA Statement 全文

At its meeting today, the Board decided to leave the cash rate unchanged at 2.5 per cent. Growth in the global economy is continuing at a moderate pace, helped by firmer conditions in the advanced countries. China's growth remains generally in line with policymakers' objectives

. Commodity prices in historical terms remain high, but some of those important to Australia have declined this year

. Financial conditions overall remain very accommodative. Long-term interest rates and risk spreads remain very low

. Emerging market economies are receiving capital inflows. Volatility in many financial prices is currently unusually low. Markets appear to be attaching a very low probability to any rise in global interest rates, or other adverse event, over the period ahead. In Australia, growth was firmer around the turn of the year, but this resulted mainly from very strong increases in resource exports as new capacity came on line; smaller increases in such exports are likely in coming quarters. Moderate growth has been occurring in consumer demand. A strong expansion in housing construction is now under way

. At the same time, resources sector investment spending is starting to decline significantly

. Signs of improvement in investment intentions in some other sectors are emerging, but these plans remain tentative as firms wait for more evidence of improved conditions before committing to significant expansion. Public spending is scheduled to be subdued

. Overall, the Bank still expects growth to be a little below trend over the year ahead

. There has been some improvement in indicators for the labour market this year

, but it will probably be some time yet before unemployment declines consistently

. Recent data showed an increase in inflation, with both headline and underlying measures affected by the decline in the exchange rate last year. But growth in wages has declined noticeably and is expected to remain relatively modest over the period ahead

, which should keep inflation consistent with the target even with lower levels of the exchange rate. Monetary policy remains accommodative. Interest rates are very low and for some borrowers have continued to edge lower over recent months

. Savers continue to look for higher returns in response to low rates on safe instruments. Credit growth has picked up a little, including most recently to businesses. The increase in dwelling prices has been slower this year than last year

, though prices continue to rise

. The exchange rate remains high by historical standards, particularly given the declines in key commodity prices, and hence is offering less assistance than it might in achieving balanced growth in the economy.

Looking ahead, continued accommodative monetary policy should provide support to demand and help growth to strengthen over time. Inflation is expected to be consistent with the 2–3 per cent target over the next two years

. In the Board's judgement, monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target

. On present indications, the most prudent course is likely to be a period of stability in interest rates.

韬客社区www.talkfx.co

发表于:2014-08-05 05:43只看该作者

16楼

韬客社区www.talkfx.co

发表于:2014-08-05 06:44只看该作者

17楼

小心谨慎,耐心耐心再耐心!

发表于:2014-08-07 02:15只看该作者

18楼

ABS 的劳动力报告评论摘要:

Australia's unemployment rate increased by 0.3 percentage points (based on unrounded estimates) to 6.4% in July 2014 (seasonally adjusted). The increased unemployment rate resulted from increased participation with the number of persons in the labour force increasing by 43,400 persons

, and the number of employed persons decreasing by 300. The net result was the number of unemployed persons increased by 43,700 to 789,000 in July 2014 (seasonally adjusted). In trend terms the unemployment rate increased 0.1 percentage points (based on unrounded estimates) to 6.1% in July 2014, following a revision to the June 2014 estimate. The number of unemployed persons in July 2014 increased by 9,500 to 756,700. Trend estimates reduce the impact of the irregular component of the seasonally adjusted series and can provide a better a better basis for analysing the underlying behaviour of the series. In original terms (where the seasonal and irregular influences have not been removed) the number of employed persons decreased by 11,900 persons between June and July 2014 and the number of unemployed persons increased by 19,300. The seasonally adjusted increase in unemployment was stronger than the increase in original terms, reflecting that historically there is usually a decrease in unemployed persons in July in original terms. The incoming rotation group for July 2014 had a lower proportion of employed persons and a higher proportion of unemployed persons compared to the sample it replaced. Therefore the incoming rotation group contributed more persons to the labour force and to the increased unemployment rate. The incoming rotation group contributed about one-third of the absolute change in the number of persons unemployed and 40% of the absolute change in male unemployment. July 2014 saw the seasonally adjusted participation rate increase by 0.1 percentage points to 64.8%. The trend participation rate was unchanged at 64.7% in July 2014. The seasonally adjusted number of employed persons decreased by 300 in July 2014 to 11,576,600 persons. In trend terms, employment increased by 4,600 persons to 11,582,200 persons in July 2014. The employment to population ratio, which expresses the number of employed persons as a percentage of the civilian population aged 15 years and over, decreased 0.1 percentage points to 60.7% (seasonally adjusted). The trend employment to population ratio remained steady at 60.8%, following a revision to the June 2014 estimate. ............

发表于:2014-08-07 02:42只看该作者

19楼

我澳纽还是继续看空