[欧元]我想这样下,他想那样下(翻译单法精华)

高手入场,其重要比重占70%以上,高手及时的出场,占挽回损失的贡献比占90%。

如果,入场重要的话,

那么内容是什么呢?

PA 单法 翻译:

好的进场点:进场“就备”模式=SETUP名词:Final flag 最后旗形(翻译成末端旗形)high/low 1 or 2 Either a high 1 or 2 or a low 1 or 2.high 1, 2, 3, or 4 高突1(第一次休后高)突高1A high 1 is a bar with a high above the prior bar in a bull flag or near the bottom of a trading range. If there is then a bar with a lower high (it can occur one or several bars later), the next bar in this correction whose high is above the prior bar's high is a high 2. Third and fourth occurrences are a high 3 and 4. A high 3 is a wedge bull flag variant.lower low A swing low that is lower than a previous swing low.low 1, 2, 3, or 4 低突1(第一次休后低)突低1A low 1 is a bar with a low below the prior bar in a bear flag or near the top of a trading range.If there is then a bar with a higher low (it can occur one or several bars later), the next bar in this correction whose low is below the prior bar's low is a low 2. Third and fourth occurrences are a low 3 and 4. A low 3 is a wedge bear flag variant.Probability of success of 60 percent or better (reward has to be at least as big as risk to break even):Buying a high 2 pullback to the moving average in a bull trend.在上升趋势里,当 突高2的回撤拉回到20均线时 买入(进场)Selling a low 2 pullback to the moving average in a bear trend.在下降趋势里,当 突低2的回撤拉回到20均线时 卖出沽空(进场)Buying a wedge bull flag pullback in a bull trend.在上升趋势里逢呈楔形看涨旗形出现时 买入做多Selling a wedge bear flag pullback in a bear trend.在下降趋势里逢呈楔形看跌旗形出现时 卖出沽空Buying a breakout pullback from a breakout of a bull flag in a bull trend.在上升趋势里,行情从看涨旗形区突破接着走突破的回撤,这时买入Selling a breakout pullback from a breakout of a bear flag in a bear trend.在下跌趋势里,行情从看跌旗形区突破接着走突破的回撤,这时沽空Buying a high 1 pullback in a strong bull spike in a bull trend, but not after a buy climax.牛市的的激突段强涨买在回撤稍停的H1(突高1)处,但是避免在买方高潮后如此Selling a low 1 pullback in a strong bear spike in a bear trend, but not after a sell climax.熊市的的激突段强跌空在回撤稍停的L1(突低1)处,但是避免在卖方高潮后如此Shorting at the top of a trading range, especially if it is a second entry.在一个交易区间的顶做空,如果是第二次入场更好(即二尝才入)Buying at the bottom of a trading range, especially if it is a second entry.在一个交易区间的底做多,如果是第二次入场更好(即二尝才入)以上是顺势的Trend reversals: 下面是趋势反转:After a strong break of the trend line, look for a reversal after a test of the trend's extreme where there is a good reversal signal bar. Traders are looking to buy a higher low or a lower low at a bottom, or to short a higher high or a lower high at a top.当走势强力突破原趋势线后,下一步可寻找符合条件的反转,在离开最初的(最高或低的)极端点后行情折返进行趋近极端点附近的回测,这个回测进行后就是条件,同时需要在转折处出现很好的逆转(反转)信号棒(短弱的不算好,折返强趋势长棒则好)。Strong final flag reversal.Buying a third or fourth push down in a bear stairs pattern for a test of the low of the prior push down.(对强 末止旗形处的逆转)在下跌梯形模式(见叠梯的定义:查 《CLBDlearn2》)的第三或第四下推(经典波浪理论的调整浪内部的第5浪或7浪=abcdeF)的逆市买入,期望以下走势从更低的地方反升起来,升的目标是这个梯形图前一个下推底=稍高些发生在前面的子行情的最低端。Selling a third or fourth push up in a bull stairs pattern for a test of the high of the prior push up.在上升梯形模式(见叠梯的定义:查 《CLBDlearn2》)的第三或第四上推(经典波浪理论的调整浪内部的第5浪或7浪=abcdeF)的逆市沽空,期望以下走势从更高的地方反跌而下,跌的目标是这个梯形图前一个上推顶=稍高些发生在前面的子行情的最高端。Entering using limit orders; this requires more experience reading charts, because the trader is entering in a market that is going in the opposite direction to the trade. However, experienced traders can reliably use limit or market orders with these setups:以下用限价单进行;在解读图表方面需要更多经验,因为交易者入场方向和当前趋势方向是反的,当然,有经验的交易者能可靠运用限价单或市价单做好这些进场点(SETUP):Buying a bull spike in a strong bull breakout at the market or at the close of the bar, or on a limit order at or below the low of the prior bar (entering in spikes requires a wider stop and the spike happens quickly, so this combination is difficult for many traders).在一个强突破中在上升激突走势段就买入,买法可下市价单或在行突破的烛的棒子的收盘价初做买向单,或挂限价单在前面棒子的底设买(注:价格跌回可以成交,但突然大幅上升则不能成交)。<做这样的激突行情单需要宽止损,且激突都是快动的,所以两个境况同现将导致很多交易者感觉困难>Selling a bear spike in a strong bear breakout at the market or at the close of the bar, or on a limit order at or above the high of the prior bar (entering in spikes requires a wider stop and the spike happens quickly, so this combination is difficult for many traders).在一个强突破中在下跌激突走势段就沽空,单法可下市价单或在行突破的烛的棒子的收盘价处做卖向单,或挂限价单在前面棒子的顶或高过顶处设卖空(注:价格跌回可以成交,但突然大幅下跌则不能成交)。<做这样的激突行情单需要宽止损,且激突都是快动的,所以两个境况同现将导致很多交易者感觉困难>Buying a bear breakout at around a measured move, if the breakout is not too strong—for example, if the range is about four points tall in the Emini, buying on a limit order at four points below the range, risking four points, and expecting a test of the breakout point. Only very experienced traders should consider this.逆向之单,只限于非常有经验的交易者作:Selling a bull breakout at around a measured move, if the breakout is not too strong—for example, if the range is about four points tall in the Emini, selling on a limit order at four points above the range, risking four points, and expecting a test of the breakout point. Only very experienced traders should consider this.Buying at or below a low 1 or 2 weak signal bar on a limit order in a possible new bull trend after a strong reversal or at the bottom of a trading range.Shorting at or above a high 1 or 2 weak signal bar on a limit order in a possible new bear trend after a strong reversal or at the top of a trading range.这段没翻译,等待Buying at or below the prior bar on a limit order in a quiet bull flag at the moving average.Shorting at or above the prior bar on a limit order in a quiet bear flag at the moving average.Buying below a bull bar that breaks above a bull flag, anticipating a breakout pullback.Selling above a bear bar that breaks below a bear flag, anticipating a breakout pullbackPAGE 331Probability of success of about 50 percent (reward has to be at least 50 percent greater than risk to break even):The initial entry when scaling into a position in a trading range.Buying or selling in a tight trading range, expecting a breakout that would result in a profit that is several times greater than your risk.Shorting a lower high in a trading range when the trend might be reversing down, or buying a higher low when the trend might be reversing up. Since the entry is in the middle of the trading range, the probability is 50 percent, but the reward is usually twice the risk.Probability of success of 40 percent or less (reward has to be at least twice the size of risk):Buying at the bottom of a bear trend or shorting at the top of bull trend where the reversal trade allows for a small risk and a very large reward—for example,shorting a rally to a clear resistance level, entering on a limit order at one tick below the resistance, and having a protective stop at one or two ticks above it. There are several examples in the chapter on entering on limit orders.Probability of success of 40 percent to 60 percent, depending on circumstances (reward has to be at least twice the size of risk to break even when the probability is only 40 percent):Buying a breakout test in a bull trend on a limit order as the market is falling, or shorting a breakout test in a bear trend on a limit order as the market is rising.Buying below a low 1 or 2 signal bar, even if it is not weak, on a limit order (a potential higher low) in a new bull trend or at the bottom of a trading range, or shorting above a high 1 or 2 signal bar, even if it is not weak, on a limit order (a potential lower high) in a new bear trendor at the top of a trading range. For example, if the market might be completing a wedge reversal top in a bull trend and pulls back for a bar or a few bars, shorting above the high 1 and high 2 signal bars is shorting in what you hope is a new bear swing.Fading magnets, like shorting at a measured move up in a bull trend or buying at a measured move down in a bear trend.Buying a sell climax around the close of an unusually large bear trend bar in an area of support in an overdone bear trend (climaxes are discussed in book 3).Selling a buy climax around the close of an unusually large bull trend bar in an area of resistance in an overdone bull trend.Beginning traders quickly learn that trading trends appears to be an excellent way to make money. However, they soon discover that trading trends is actually just as difficult as anyother type of trading. For them to make money, someone else has to lose it. The market is a zero-sum game being played by countless smart people on both sides. This guarantees that the three variables in the trader's equation will always keep the edge small and difficult to assess. For a trader to make money, he has to be consistently better than half of the other traders out there. Since most of the competitors are profitable institutions, a trader has to be very good. In a trend, the probability is often smaller than a beginner would like, and the risk is larger. In a trading range, the risk is not great, but neither is the probability or the reward. In a reversal, although the reward can be large, the risk is often big as well and the probability is small. In a scalp, the probability is high, but the reward is small compared to the riskAll cited from Trading Price Action: trading range 交易区间篇阿尔 布鲁克斯 著TRERMSreversal bar A trend bar in the opposite direction of the trend. When a bear legis reversing up, a bull reversal bar is a bull trend bar, and the classic descriptionincludes a tail at the bottom and a close above the open and near the top. A bearreversal bar is a bear trend bar in a bull leg, and the traditional descriptionincludes a tail at the topand a close below the open and near the bottom.逆转棒(反转棒烛):某向的趋势里生出一个反向的趋势棒来(趋势棒就是有烛体长度的非盘整型棒)。当一个下跌行情段(或肢)在逆转时,那个生出的逆转棒(看涨),就是看涨趋势棒:很典型的描述就是此棒(烛)在底部是下影线,而收盘在开盘之上并收在接近棒顶段。spike and channel A breakout into a trend in which the follow-through is in theform of a channel where the momentum is less and there is two-sided trading takingplace.激突接通道形:一般走势突破成(较陡)趋势走势然后接着的走势呈现斜通道形式,其动量稍减,在此发生双向交易。==spike 翻译成速行段,激突行情比较多,口语的“快推走势”也行StairA push to a new extreme in a trending trading range trend or a broad channeltrend where there is a series of three or more trending swings that resembles asloping trading range and is roughly contained in a channel. After the breakout,there is a breakout pullback that retraces at least slightly into the prior tradingrange, which is not a requirement of other trending trading ranges. Two-way tradingis taking place but one side is in slightly more control, accounting for the slope.多区叠梯(“楼梯”图形)在一个斜趋势性交易区间的趋势中或在一个宽的斜通道的趋势里,发生推进到新极端价,这个推进过程的形式如下:包含一系列三个或更多的趋势摆动行情,这多个摆动形成较倾斜的交易区间并粗略地被包含在一个通道内。在某区顶(底)起突破发生后,这突破的回撤会少撤退到原交易区间内部少许。这个特点是其他类型的趋势性交易区间不具备的。交易上可以进行双向(就是上卖而下买)的交易,根据俯仰不同而让一边的买卖较占优势(一般整段俯则买空的一边偏优,整段仰则买多的稍优)。

发表于:2013-07-01 02:34只看该作者

2楼

居然是我 第一次哦 沙发 真开心

韬客社区www.talkfx.co

发表于:2013-07-01 02:41只看该作者

3楼

谢谢楼主分享翻译

韬客社区www.talkfx.co

4楼

本帖最后由 精工美元 于 2013-7-4 15:00 编辑

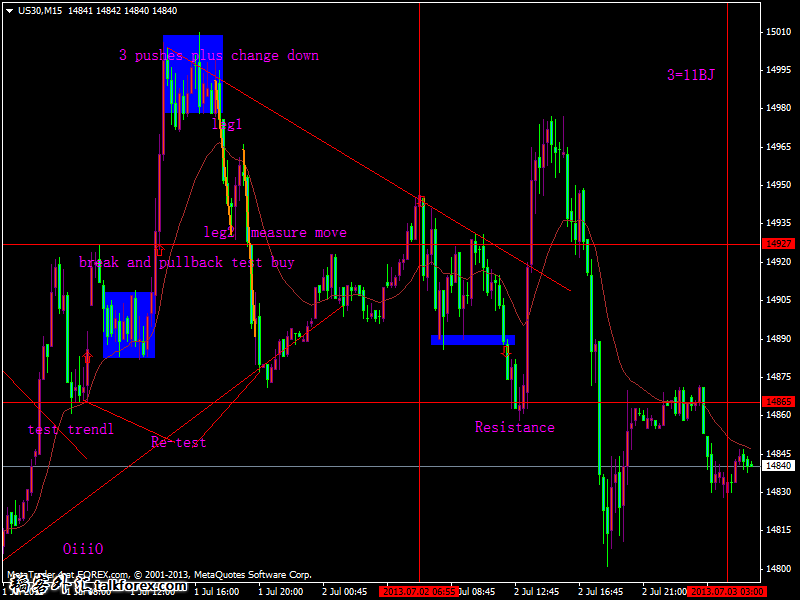

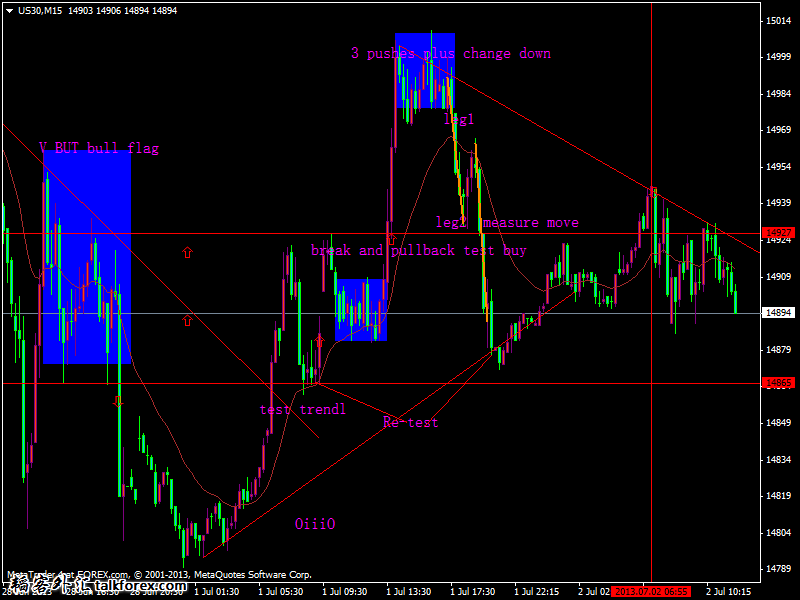

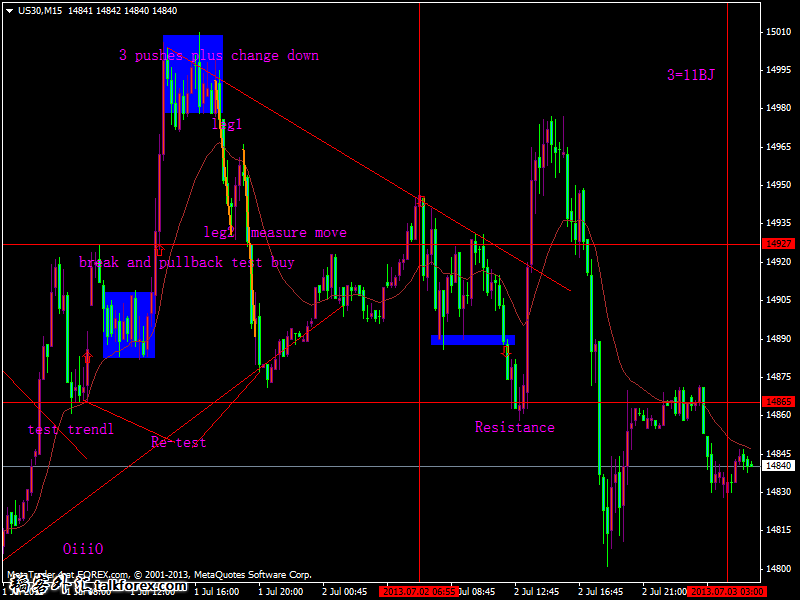

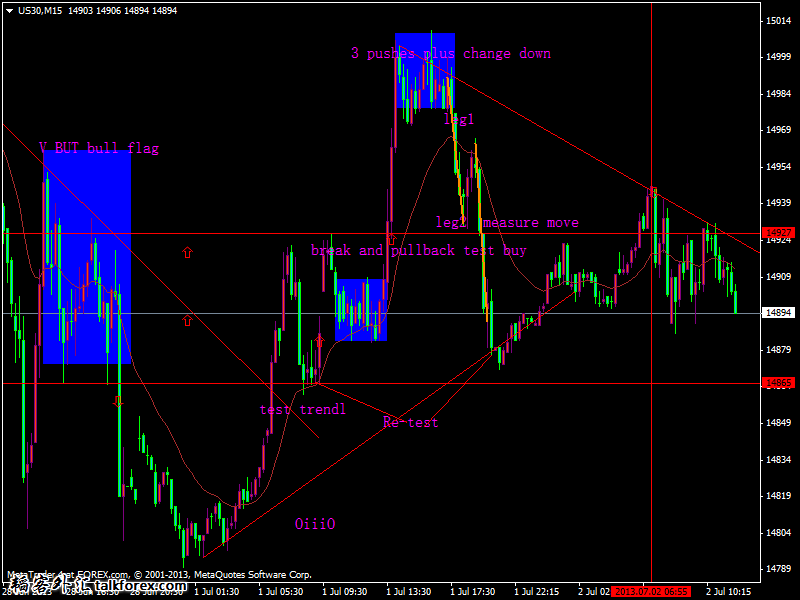

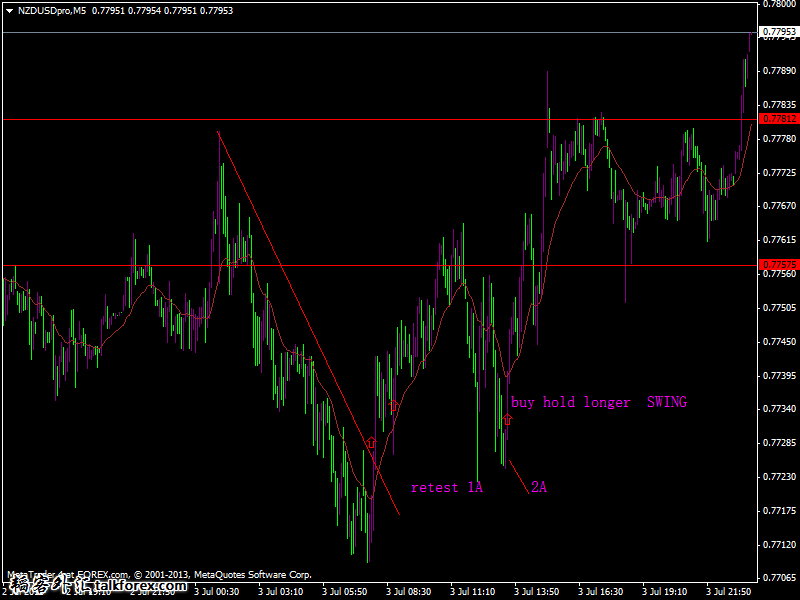

有一批图片,现在剩3

us30m157-3=san.png

us30m157-3=san.png us30m15 dow72.png

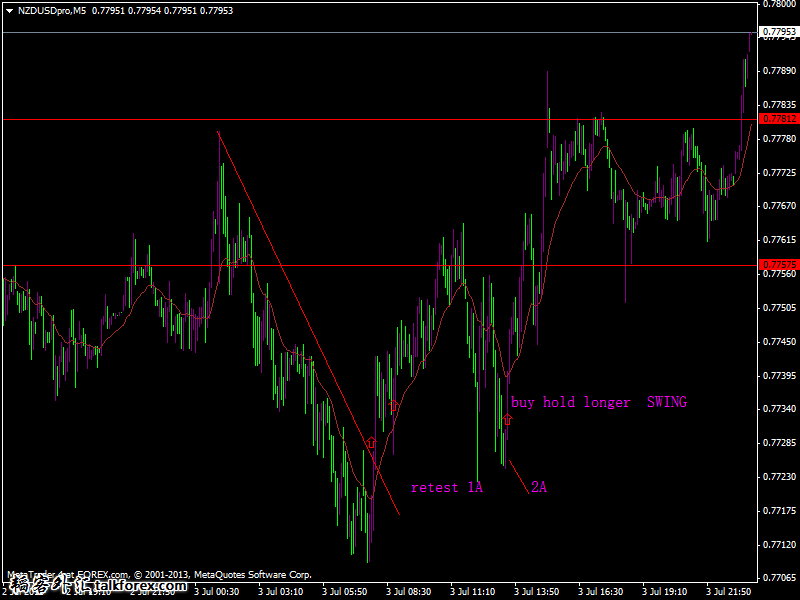

us30m15 dow72.png nzdusdprom5send447.png

nzdusdprom5send447.png

us30m157-3=san.png

us30m157-3=san.png us30m15 dow72.png

us30m15 dow72.png nzdusdprom5send447.png

nzdusdprom5send447.png韬客社区www.talkfx.co

发表于:2013-07-04 09:01只看该作者

5楼

学习......

韬客社区www.talkfx.co