发表于:2013-05-06 12:07只看该作者

2楼

信传言?!

信事实!?

韬客社区www.talkfx.co

发表于:2013-05-06 12:34只看该作者

3楼

......

韬客社区www.talkfx.co

发表于:2013-05-06 13:49只看该作者

5楼

明天澳元降息的概率大,不过我对澳元不熟啊。没有参与

韬客社区www.talkfx.co

发表于:2013-05-06 14:11只看该作者

6楼

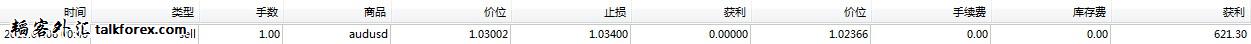

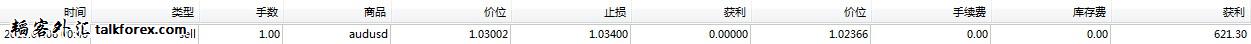

希望是真的,我一早就空了澳元了.所有机构报告一致看空澳元,市场炒作澳洲在未来数月内降息50基点..

aud.jpg

aud.jpg

aud.jpg

aud.jpg韬客社区www.talkfx.co

8楼

韬客社区www.talkfx.co

发表于:2013-05-06 14:26只看该作者

9楼

有钱一起赚,大家一起研究研究~!!

商品货币有可能会走跌,可以看以下的文章Triple Positives in US Jobs

A rare triple positive in US jobs report; strong NFP; strong upward revisions; lowest unemployment rate since December 2008 underlines the improving situation in US jobs, but the disinflationary dynamics in the US and global economy should continue to bolster the arguments of the doves at the Fed. Speculation that Fed dove Janet Yellen will succeed Ben Bernanke will also sway the balance against tapering QE.

Despite this week’s headline-grabbing news in currencies

this week (potential for negative Eurozone rates and possibility for Fed to raise asset purchases), the tug of war between the two most liquid currencies

implies continued consolidation in EUR/USD between the 1.2900-1.3200 range.

Draghi’s “Negative Rate” remarks are more Talk than Action Draghi’s reference to negative deposit rates is seen more of a verbal jawboning of the euro in the event of another euro rally resulting from the Fed’s weighing of more asset purchases, rather than an actual statement of intent.

The ECB cannot afford to penalize member banks via negative deposit rates as it will encourage hoarding of cash. This also unsuitable for a region where banks are required to raise capital.

Sharpening Divergence Between Market & Macro Metrics The ECB’s rate cutting decision was all about addressing the economy, rather than liquidity conditions.Thedecline in Eurozone CPI to 33-month lows (the biggest monthly point-drop since July 2009), the dual contraction in Germany’s manufacturing and services sectors, the seveth quarterly growth contraction in Spain as well a new record unemployment rate of 26.7% are all in contrast with three-year lows in Spanish and Italian yields, a stable EURIBOR and a steady currency.

These deteriorating macro factors imply inevitable currency jawboning rhetoric from ECB and govt officials (especially the election-bound Merkel) in the event of excessive euro appreciation. Fears of a German double dip will likely escalate after Germany’s Q4 GDP q/q was -0.6%.

Fed QE to remain unchanged, before increasing in 2014 We never subscribed to the notion of “tapering” QE by the Fed for a number of reasons:

- The projected loss of 2 million jobs and a decline of 0.6% in US GDP from the sequester is a significant contraction of economic

activity

- Consumer and business sending cannot make up for plummeting Federal spending when asset markets decline as a result of falling QE

- The increasing threat of disinflation is overshadowing any fears of inflation, giving the US and other central banks little choice but to stick with asset purchases

More Downside for Commodity Currencies With all 6 metals

down on the year and energy prices being the only group in the green, the commodity currency story has more downside ahead.

Canadian Dollar faces More Downside The appointment of the head of Canada’s export agency to the helm of the Bank of Canada means that Canadian exporters will finally find an ally at the central bank. Stephen Poloz is likely to be more attentive to the needs of exporters via capping the Canadian dollar, which was not the case with Marc Carney. Renewed weakness in the US and shaky outlook for Canadian banks will lead the Bank of Canada in reducing its hawkish stance to the detriment of the currency. Expect USD/CAD nearing 1.03, followed by 1.0500.

Aussie Downwside far from done Deteriorating Aussie employment figures (four-year high unemployment rate) and broad deterioration in business surveys will add to the deterioration in the currency. And while there is no Chinese hard landing, don’t expect any notable recovery either, which will weigh on Aussie prospects. Finally, with Japan’s Asian trade feeling the pinch from the falling yen, their cooling economies will be another factor weighing on the Aussie. Expect AUD/USD back to parity from current 1.0300.

A rare triple positive in US jobs report; strong NFP; strong upward revisions; lowest unemployment rate since December 2008 underlines the improving situation in US jobs, but the disinflationary dynamics in the US and global economy should continue to bolster the arguments of the doves at the Fed. Speculation that Fed dove Janet Yellen will succeed Ben Bernanke will also sway the balance against tapering QE.

Despite this week’s headline-grabbing news in currencies

this week (potential for negative Eurozone rates and possibility for Fed to raise asset purchases), the tug of war between the two most liquid currencies

implies continued consolidation in EUR/USD between the 1.2900-1.3200 range.

Draghi’s “Negative Rate” remarks are more Talk than Action Draghi’s reference to negative deposit rates is seen more of a verbal jawboning of the euro in the event of another euro rally resulting from the Fed’s weighing of more asset purchases, rather than an actual statement of intent.

The ECB cannot afford to penalize member banks via negative deposit rates as it will encourage hoarding of cash. This also unsuitable for a region where banks are required to raise capital.

Sharpening Divergence Between Market & Macro Metrics The ECB’s rate cutting decision was all about addressing the economy, rather than liquidity conditions.Thedecline in Eurozone CPI to 33-month lows (the biggest monthly point-drop since July 2009), the dual contraction in Germany’s manufacturing and services sectors, the seveth quarterly growth contraction in Spain as well a new record unemployment rate of 26.7% are all in contrast with three-year lows in Spanish and Italian yields, a stable EURIBOR and a steady currency.

These deteriorating macro factors imply inevitable currency jawboning rhetoric from ECB and govt officials (especially the election-bound Merkel) in the event of excessive euro appreciation. Fears of a German double dip will likely escalate after Germany’s Q4 GDP q/q was -0.6%.

Fed QE to remain unchanged, before increasing in 2014 We never subscribed to the notion of “tapering” QE by the Fed for a number of reasons:

- The projected loss of 2 million jobs and a decline of 0.6% in US GDP from the sequester is a significant contraction of economic

activity

- Consumer and business sending cannot make up for plummeting Federal spending when asset markets decline as a result of falling QE

- The increasing threat of disinflation is overshadowing any fears of inflation, giving the US and other central banks little choice but to stick with asset purchases

More Downside for Commodity Currencies With all 6 metals

down on the year and energy prices being the only group in the green, the commodity currency story has more downside ahead.

Canadian Dollar faces More Downside The appointment of the head of Canada’s export agency to the helm of the Bank of Canada means that Canadian exporters will finally find an ally at the central bank. Stephen Poloz is likely to be more attentive to the needs of exporters via capping the Canadian dollar, which was not the case with Marc Carney. Renewed weakness in the US and shaky outlook for Canadian banks will lead the Bank of Canada in reducing its hawkish stance to the detriment of the currency. Expect USD/CAD nearing 1.03, followed by 1.0500.

Aussie Downwside far from done Deteriorating Aussie employment figures (four-year high unemployment rate) and broad deterioration in business surveys will add to the deterioration in the currency. And while there is no Chinese hard landing, don’t expect any notable recovery either, which will weigh on Aussie prospects. Finally, with Japan’s Asian trade feeling the pinch from the falling yen, their cooling economies will be another factor weighing on the Aussie. Expect AUD/USD back to parity from current 1.0300.

韬客社区www.talkfx.co

发表于:2013-05-06 14:51只看该作者

10楼

高盛上年12月唱空澳元,说今年一月份澳元要到1.03,5月份要到0.98,因为澳元要降息,和矿石出口疲软,因为中国的原因

韬客社区www.talkfx.co

发表于:2013-05-06 15:15只看该作者

11楼

韬客社区www.talkfx.co

12楼

韬客社区www.talkfx.co

发表于:2013-05-06 15:34只看该作者

13楼

韬客社区www.talkfx.co

发表于:2013-05-06 15:39只看该作者

14楼

本帖最后由 lijianhui 于 2013-5-6 23:41 编辑

不信市场传言,除非看到汇率下跌,我就信,不过也不信是索罗斯做的,机构做空就将责任推索罗斯身上,反正大家都知道索罗斯。

而且,狡猾的人都会用传言观察市场反应,信的人多了就成风了,趁机入货好,出货好,自由选择,但是大众注意力放在澳元上,是肯定的

韬客社区www.talkfx.co

发表于:2013-05-07 03:07只看该作者

16楼

澳元得罪谁了,都要坐空澳元,传言衰神光临此贴,看看效果怎样、。。。。。

韬客社区www.talkfx.co

发表于:2013-05-07 14:03只看该作者

18楼

周五,澳联利息声明,会加速下跌吗?

韬客社区www.talkfx.co

发表于:2013-05-07 14:20只看该作者

19楼

Who the heck cares about rumors/gossips/claims/reports that some bigshot/heavyweight might be getting ready to short/long something? You know what's the most expensive thing in the world? It's the TRUTH. We are traders. We make the game plan then proceed to implement it NO MATTER WHAT.

韬客社区www.talkfx.co