2楼

下面这篇Technical Analysis Fallac(技术分析的误区),是在FF上看的,作者fti对交易领悟的很深,说的很实在。

Technical Analysis Fallacy

--------------------------------------------------------------------------------

Apologies

-no mentor, or course, or literiture can give anyone the holy grail to the secrets of success in trading in the markets.

-"and no one, sells the goose that lays golden eggs, probably the eggs, but never the goose"

Nevertheless, I will humbly attempt.

Since the late 70s and into the millinium.

Many "engineers" have made public, their inventions of reading probabilities into Technical Indicators. Many Technical Analysis Gurus came to the forefront to sell their research findings. To name a few,

The Grand daddy being Charles Dow and his Dow theory which later lead to the creation of the Dow Jones Indexes.

Rene Descarte who introduced the Spiral studies.

Leonardo Da vincci who fostered the fabonacci principles,

W.D. Gann, who introduced Cyclic Studies of Squaring time and price.

R.N.Elliot, who introduced the Elliot Wave Studies

W.Wilders.Who introduced the mathematics of calculating overbought and oversold markets by his introduction of the DI+,DI-, ADX lines and the Relative Strength Index.

The Stocastics, MACDs, ……………………………...etc

If one was to impliment all these studies onto their charts. What you will see is a beautiful piece of art, displaying very impressive hog wash, that do nothing but dazzle the uninitiated. If anything else it 'll confuse you even more.

Then you have the charting specialist who have introduced many ways to chart eg,

Linear Charts, HiLoClose Bar Charts, Japanese candlestick charts, Point & Figuring, John Hill's Bar Chart congestion & reversal patterns, reverse point waves, pivots, fractuals, ………..etc

Today, we find lots of originally and mutated techniques and methodologies available to the Chartist or Technicians.

What many fail to realise, is that all these studies, basically are statistical tables plotted in graphic form to present a "picture" to assist traders in their decision process. The maxim being, that a picture tells a thousand words.

"It is not theirs (the charts) to reason why,

But to signal Sell or Buy,

For the traders to do or die,

Hoping that the signal does not lie,

I would, from my many years of studies, go so far as to say, that they all work, some more than others but they all do serve a purpose. (to give traders, the "guts" to do or die)

If I may borrow from the quotes of Sir Winston Chirchill.

"That you can lie to some people all the time, all people some of the time, but not to all people, all the time."

Similarly, theses studies can work in some market conditions all the time, all market conditions some of the time, but not all market conditions all of the time."

Think about what I've just quoted very carefully.

The problem with some people and some professional Technical Analyst today ( being a certified Technical Analyst myself ) is that they use the Technical studies as if, it were the "Holy Grail" of trading & their pathway to the millions.

How far that is from the truth.

Any person with a good brain on their shoulders, will ultimate come to the realisation that these are just tools. Tools that are built on historical and lagging databases. Moreover the rigidity of the parameters used in the studies imposes rigid responses to changing market conditions. Have we forgotten that the market is a live beast that learns and adapts to trader behaviours? Many have forgotten that the market is the sum total of the behaviour of the participants engaged in the market place. These tools are used for measuring the markets health, not so unlike the thermometer to a doctor, or the measuring tape to a carpenter, just a tool.

Then how is it possible that these studies themselves can be considered the "Holy Grail"?

It may be due to ignorance (being new and uniniatiated), lazyness, or just plain stubborness ( a little knowledge is a dangerous thing). Of course it is not nice for me, to tell you about those who have "a little knowledge", trying to scam those who know less than them. That's another story.

Some do so, because of a very new disease discovered recently, the sickness of "the chance".

If you use the Technical studies as your "Holy Grail", I have only one word for you, GAMBLER.

I put it to you, that, to consider your Technical Studies to be more than what they are is a "fallacy" in trading the markets, not so unlike martingale gamblers' fallacy. It can lead you to a very dark place.

What many traders do not know, or may fail to recognise, is that your success in taming the markets, is comprised of a mix of ingredients. Not so unlike in baking cakes.

I suggest three very important ingredients. One is " Market Structure ", the other is "YOU", then Capitalisation. Of course there are many more components, for the moment these seems of dominant importance, in my humble opinion.

I hope you will think about what I've said very carefully.

I shall try to push these doors ajar for you slowly to show you the light at the end of the tunnel (please hope its no on-coming train), God willing.

不一定看对,一定要作对。看错不可怕,作错才可畏。

3楼

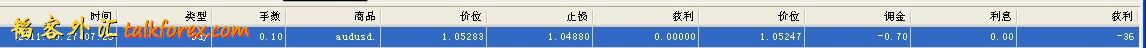

刚刚追高开仓了澳美,0.1手多单。昨晚受消息影响,澳美深幅回档,扫掉了止盈价,0.2手澳美多单只是微赚。 20111027.jpg

20111027.jpg

20111027.jpg

20111027.jpg不一定看对,一定要作对。看错不可怕,作错才可畏。

4楼

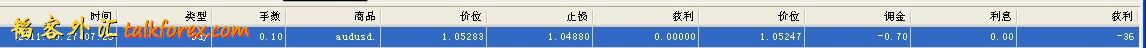

0.1手澳美,已经平仓,获利151美金。

跟踪了澳美一两周,舞步踩的还比较准。上一次交易被扫止盈后,今天早上发现了做多的大机会,虽然已经大涨,追高进去,但是运气好继续大涨赚了152点。

计划基本上执行了,好像是50点BE。然后没有做移动止盈,一直涨到150点后,判断美元走势,和澳美走势,觉得后面空间不大。按照短线快进快出操作思路,落袋为安。 20111027 v2.jpg

20111027 v2.jpg 20111027.jpg

20111027.jpg

20111027 v2.jpg

20111027 v2.jpg 20111027.jpg

20111027.jpg不一定看对,一定要作对。看错不可怕,作错才可畏。

发表于:2011-10-27 14:39只看该作者

5楼

英文的,看不懂啊

爆仓一次就代表着失败

发表于:2011-10-27 16:20只看该作者

6楼

大概是说技术分析没用?

趋势线?

均线?

蜡烛?

K线?

韬客社区www.talkfx.co

7楼

也不是说技术分析没有用,是谈技术分析是有一定局限性的,不能偏执夸大技术分析的作用。更重要的,技术分析之上,要结合资金管理、结合操盘手的性格、研究人性。

“一流高手用理念,二流高手凭资金管理,三流高手靠技术。层次是渐进的,如果人能达到用理念去进行操作,那么其人也必定是历经磨炼的。”

个人体会,不要一直纠缠在技术分析上。更重要的要运用好资金管理,以及提高心态方面的自我修炼,最终达到用理念操盘的境界。

9楼

观察了大半天澳美,刚才找机会试探开了0.1手的多单,作为底仓。

密切注意美元的走势,美元前期的大底已经越来越近了。

[ 本帖最后由 satsnow 于 2011-10-28 16:23 编辑 ] 20111028v2.jpg

20111028v2.jpg

20111028v2.jpg

20111028v2.jpg不一定看对,一定要作对。看错不可怕,作错才可畏。

发表于:2011-10-28 12:32只看该作者

12楼

ok................

韬客社区www.talkfx.co

13楼

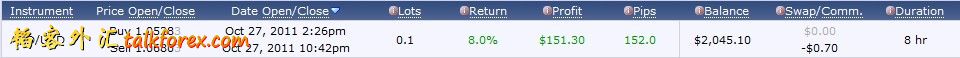

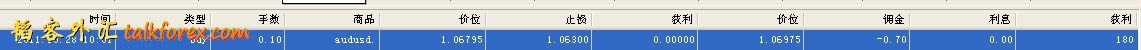

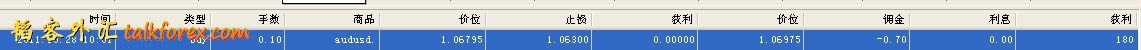

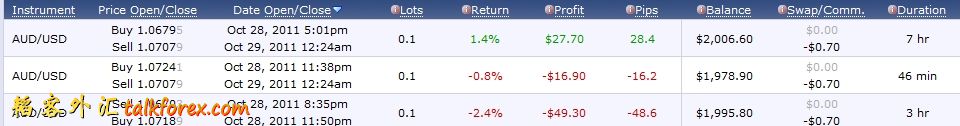

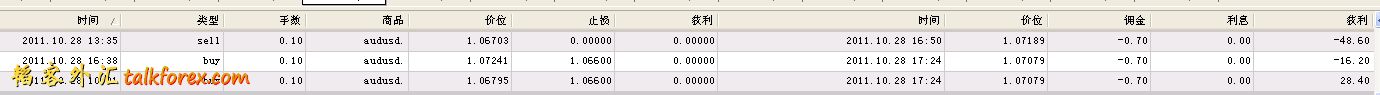

澳美这次共开了三单,刚才全部平仓了,总共亏损-36美金。

第一单多单,开仓后盈利了十几点,后来趋势转向。

然后开了第二单空单,锁仓并观察后市情况。后市震荡,然后选择了上涨。

在解锁的时候,出现了失误:

1、解锁位置波段偏高,平掉亏损空单后,趋势回档多单紧跟着缩水;

2、解锁后马上激进的加仓第三单多单,仓位加大后,回档风险明显加大。观察了大概10-20个点的回档后,考虑到整体风险控制在3%以内的需要,把单子全部平仓了。

总共亏损了-36美金,操作是正确的。后面要好好把“锁仓”技术,研究一下。

“小亏大赚”,每次亏损一定要在可控范围内,一定不能出现大亏! 20111028v4.jpg

20111028v4.jpg 20111028v3.jpg

20111028v3.jpg

20111028v4.jpg

20111028v4.jpg 20111028v3.jpg

20111028v3.jpg不一定看对,一定要作对。看错不可怕,作错才可畏。

14楼

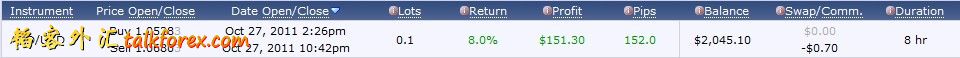

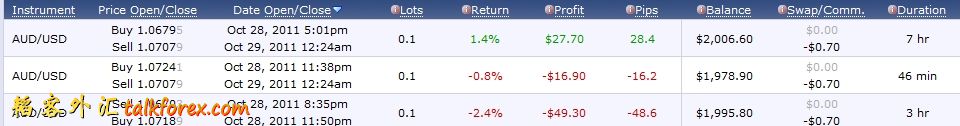

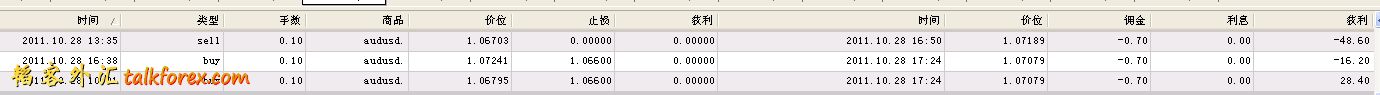

目前账户资金2,006美金 20111028v5.jpg

20111028v5.jpg

20111028v5.jpg

20111028v5.jpg不一定看对,一定要作对。看错不可怕,作错才可畏。

发表于:2011-10-29 07:08只看该作者

15楼

喜欢这句:一流高手用理念,二流高手凭资金管理,三流高手靠技术

韬客社区www.talkfx.co

16楼

There is another old saying: “you can never go broke taking a profit.” The Turtles would not agree with this statement. Getting out of winning positions too early, i.e. “taking a profit” too early, is one of the most common mistakes when trading trend following systems.

这句话太经典了,老的说法“只要赚钱,你什么时候落袋为安都是正确的”,海龟交易法不同意这一点。头寸获利后很早退出,是趋势跟踪交易的常见错误。也就是咱们常说的华尔街名言“截断亏损让利润奔跑”,必须要跑起来。

不一定看对,一定要作对。看错不可怕,作错才可畏。

17楼

Fti 讲的关于野猪的预言故事。

Hi ALL,

I had typed out the exploration sessions up to friday , then going for my vacation.

But since the markets are so letargic. Heres something to chew on.

A lesson in habit training & stupidity.

The Wild and Free Pigs of the Okefenokee Swamp

by Steve Washam based on a telling by George Gordon

---------------------------------------------------------------------

Some years ago, about 1900, an old trapper from North Dakota hitched up some horses to his Studebaker wagon, packed a few possessions, especially his traps--and drove south.

Several weeks later he stopped in a small town just north of the Okefenokee Swamp in Georgia.

It was a Saturday morning--a lazy day--when he walked into the general store.

Sitting around the pot-bellied stove were seven or eight of the town's local citizens.

The traveler spoke, "Gentlemen, could you direct me to the Okefenokee Swamp?"

Some of the old-timers looked at him like he was crazy.

"You must be a stranger in these parts," they said.

"I am. I'm from North Dakota," said the stranger.

"In the Okefenokee Swamp are thousands of wild hogs," one old man explained.

"A man who goes into the swamp by himself asks to die!"

He lifted up his leg. "I lost half my leg here, to the pigs of the swamp."

Another old fellow said, "Look at the cuts on me; look at my arm bit off!"

"Those pigs have been free since the Revolution, eating snakes and rooting out roots

and fending for themselves for over a hundred years.

They're wild and they're dangerous.

You can't trap them. No man dare go into the swamp by himself."

Every man nodded his head in agreement.

The old trapper said,

"Thank you so much for the warning. Now could you direct me to the swamp?"

They said, "Well, yeah, it's due south--straight down the road."

But they begged the stranger not to go, because they knew he'd meet a terrible fate.

He said, "Sell me ten sacks of corn, and help me load them into the wagon."

And they did.

Then the old trapper bid them farewell and drove on down the road.

The townsfolk thought they'd never see him again.

Two weeks later the man came back.

He pulled up to the general store, got down off the wagon, walked in and bought ten more sacks of corn.

After loading it up he went back down the road toward the swamp.

Two weeks later he returned and, again, bought ten sacks of corn.

This went on for a month. And then two months, and three.

Every week or two the old trapper would come into town on a Saturday morning,

load up ten sacks of corn and drive off south into the swamp.

The stranger soon became a legend in the little village and the subject of much speculation.

People wondered what kind of devil had possessed this man,

that he could go into the Okefenokee by himself and not be consumed by the wild and free hogs.

One morning the man came into town as usual.

Everyone thought he wanted more corn.

He got off the wagon and went into the store where the usual group of men were gathered around the stove.

He took off his gloves.

"Gentlemen," he said, "I need to hire about ten or fifteen wagons.

I need twenty or thirty men.

I have six thousand hogs out in the swamp, penned up, and they're all hungry.

I've got to get them to market right away."

"You've got WHAT in the swamp?" asked the storekeeper, incredulously.

"I have six thousand hogs penned up. They haven't eaten for two or three days,

and they'll starve if I don't get back there to feed and take care of them."

One of the old-timers said,

"You mean you've captured the wild hogs of the Okefenokee?"

"That's right."

"How did you do that? What did you do?" the men urged, breathlessly.

One of them exclaimed, "But I lost my arm!"

"I lost my brother!" cried another.

"I lost my leg to those wild boars!" chimed a third.

The trapper said, "Well, the first week I went in there they were wild allright.

They hid in the undergrowth and wouldn't come out.

I dared not get off the wagon. So I spread corn along behind the wagon.

Every day I'd spread a sack of corn.

"The old pigs would have nothing to do with it.

But the younger pigs decided that it was easier to eat free corn

than it was to root out roots and catch snakes.

So the very young began to eat the corn first.

"I did this every day.

Pretty soon, even the old pigs decided that it was easier to eat free corn,

after all, they were all free; they were not penned up.

They could run off in any direction they wanted at any time.

"The next thing was to get them used to eating in the same place all the time.

So, I selected a clearing, and I started putting the corn in the clearing.

"At first they wouldn't come to the clearing. It was too far.

It was too open. It was a nuisance to them.

"But the very young decided that it was easier to take the corn in the clearing

than it was to root out roots and catch their own snakes.

And not long thereafter, the older pigs also decided that it was easier to come to the clearing every day.

"And so the pigs learned to come to the clearing every day to get their free corn.

They could still subsidize their diet with roots and snakes and whatever else they wanted.

After all, they were all free. They could run in any direction at any time. There were no bounds upon them.

"The next step was to get them used to fence posts. So I put fence posts all the way around the clearing.

I put them in the underbrush so that they wouldn't get suspicious or upset, after all,

they were just sticks sticking up out of the ground, like the trees and the brush.

The corn was there every day. It was easy to walk in between the posts, get the corn, and walk back out.

"This went on for a week or two.

Shortly they became very used to walking into the clearing, getting the free corn,

and walking back out through the fence posts.

"The next step was to put one rail down at the bottom.

I also left a few openings, so that the older,

fatter pigs could walk through the openings and the younger pigs could easily jump over just one rail,

after all, it was no real threat to their freedom or independence--

they could always jump over the rail and flee in any direction at any time.

"Now I decided that I wouldn't feed them every day. I began to feed them every other day.

On the days I didn't feed them, the pigs still gathered in the clearing.

They squealed, and they grunted, and they begged and pleaded with me to feed them--

but I only fed them every other day.

Then I put a second rail around the posts.

"Now the pigs became more and more desperate for food.

Because now they were no longer used to going out and digging their own roots and finding their own food,

they now needed me. They needed my corn every other day."

"So I trained them that I would feed them every day if they came in through a gate and

I put up a third rail around the fence.

"But it was still no great threat to their freedom, because there were several gates

and they could run in and out at will.

"Finally I put up the fourth rail.

Then I closed all the gates but one, and I fed them very, very well."

"Yesterday I closed the last gate and today I need you to help me take these pigs to market."

The price of free corn.

The parable of the pigs has a serious moral lesson.

Markets have the skills as that trapper.

Remember your MO, and purpose.

If you are scalping, beware the gates.

If you are trading, then do not run too far off your norm.

If you cannot hold on to your intended prtocol and MO, then you will be caged by the market , sometime.

If you ever get into that position as a trader , you will have to fight tooth and nail, just to get out of it.

REMEMBER, you have been warned.

Sun Zi's :

"If you know the enemy and know yourself, you need not fear the result of a hundred battles.

If you know yourself but not the enemy, for every victory gained you will also suffer a defeat.

If you know neither the enemy nor yourself, you will succumb in every battle."

[ 本帖最后由 satsnow 于 2011-10-31 15:54 编辑 ]

不一定看对,一定要作对。看错不可怕,作错才可畏。

18楼

对上文中最后几句总结的翻译和理解:

--------------------------------------------------------------------------------

Markets have the skills as that trapper.

市场具有类似寓言里猎手的本领。

Remember your MO, and purpose.

记住你的操盘方法和目标。

If you are scalping, beware the gates.

如果你“割头皮”的话,随时注意风险,要保证能全身而退。

If you are trading, then do not run too far off your norm.

如果正在交易,不要远离自己熟悉的模型太远。

If you cannot hold on to your intended prtocol and MO, then you will be caged by the market , sometime.

如果不能遵守自己的纪律和操作模型,迟早要被市场伤害,甚至消灭。

If you ever get into that position as a trader , you will have to fight tooth and nail, just to get out of it.

如果你陷入了寓言中野猪的不利境地,你要有壮士断腕的勇气,截断亏损。

REMEMBER, you have been warned.

发表于:2011-10-31 08:48只看该作者

19楼

锁仓!高级仓位管理。 建议用来控制属于震荡行情的情况,毕竟震荡行情是时候才能判断的。可以先利用锁仓来控制风险。

[ 本帖最后由 tonyoder 于 2011-10-31 16:54 编辑 ]

无为而治,顺其自然

发表于:2011-10-31 09:06只看该作者

20楼

好贴

鸟语看着累

顺势 顺势 绝不抄底摸顶 绝不被套加仓